World Lung 2018 – Alunbrig squares up to Xalkori, but the field is getting crowded

World Lung 2018 – Alunbrig squares up to Xalkori, but the field is getting crowded

by Jacob Plieth

Takeda’s drug leads the charge of small-molecule tyrosine kinase inhibitors, some of which are very much holding their own against the onslaught of immuno-oncology.

It might come as a surprise that Takeda’s Alta-1L study of Alunbrig was cited at the closing World Lung press conference yesterday, alongside such practice-changing trials as Pacific and Impower-133, as one of the most important of the whole meeting.

Clearly, doctors think it is vital for drugs targeting this lung cancer niche – Alk-mutated first-line NSCLC – to treat brain metastases, where Pfizer’s incumbent, Xalkori, has no activity. Dr Anna Farago, of Massachusetts General Hospital, said that Alta-1L fell short of being practice-changing, but she added that Alunbrig should move into the first-line setting thanks to it, giving patients multiple options.

The Takeda drug is already approved second-line, in Xalkori failures, and Alta-1L was revealed to have yielded a positive progression-free result in July. At the World Lung plenary the magnitude of the PFS benefit was revealed: across the 275 subjects enrolled Alunbrig yielded a 51% reduction in risk of progression versus Xalkori (median not reached, p=0.0007).

The effect was striking in subjects with brain metastases at baseline, where risk of progression was cut by 73% versus Xalkori, which does not penetrate the brain. Pneumonitis was highlighted as a side effect possibly unique to Alunbrig, though in Alta-1L its incidence was lower than in later-line studies.

Competition

Alunbrig could become a new front-line option, but it will face stiff competition: Roche’s Alecensa, designed specifically to cross the blood-brain barrier, and Novartis’s Zykadia are already approved and challenging Xalkori’s first-line label. Pfizer’s own brain-penetrant project, lorlatinib, is filed for second-line use, and is in a pivotal first-line study.

A separate issue is activity against mutations other than Alk. Xalkori is additionally approved for NSCLC that is positive for Ros1, which neither Alecensa nor Alunbrig hits. This use gained prominence with Roche’s takeover of Ignyta last year, focused on the Ros1-targeting small molecule entrectinib.

Entrectinib itself made waves at World Lung, where its own ability to cross the blood-brain barrier was highlighted.

In an analysis of Ros1-positive patients in three different trials, Alka and Startrk-1 and 2, the University of Colorado’s Dr Robert Doebele said entrectinib yielded an overall remission rate of 77%, including 74% in subjects with baseline CNS disease. Median PFS was 26.3 months in patients without and 13.6 months in those with CNS metastases.

Many of these novel kinase inhibitors have overlapping activities; for instance, entrectinib is also active against Trk, a mechanism it has in common with Loxo’s larotrectinib, which also hits Ret.

Ret battle

Ret is also the target of another kinase inhibitor, BLU-677, in development by Blueprint Medicines, which argues that this mutation is more prevalent than previously thought. Its World Lung presentation focused on a cohort of 41 EGFR-mutant patients who had relapsed on Astrazeneca’s Tagrisso.

One of these had relapsed first on Roche’s Tarceva and then on Tagrisso, and experienced 78% tumour shrinkage when given BLU-667 – the first time clinical response had been recorded to Ret inhibition in an EGFR-mutant patient relapsed on Tagrisso, researchers said.

Yet another kinase approach that has been gaining prominence is Axl inhibition, and here Bergenbio claims to have the upper hand. Its lead asset, bemcentinib, is the only truly selective Axl inhibitor, Bergenbio’s chief executive, Richard Godfrey told Vantage.

At World Lung the company showed an analysis of 24 patients given bemcentinib and Merck & Co’s Keytruda, saying it saw a 30% remission rate among 10 PD-L1-negative subjects, who would normally not be expected to respond to Keytruda. Overall response in Axl-positive subjects was 40%, versus 9% in negatives, backing bemcentinib’s mechanism of action.

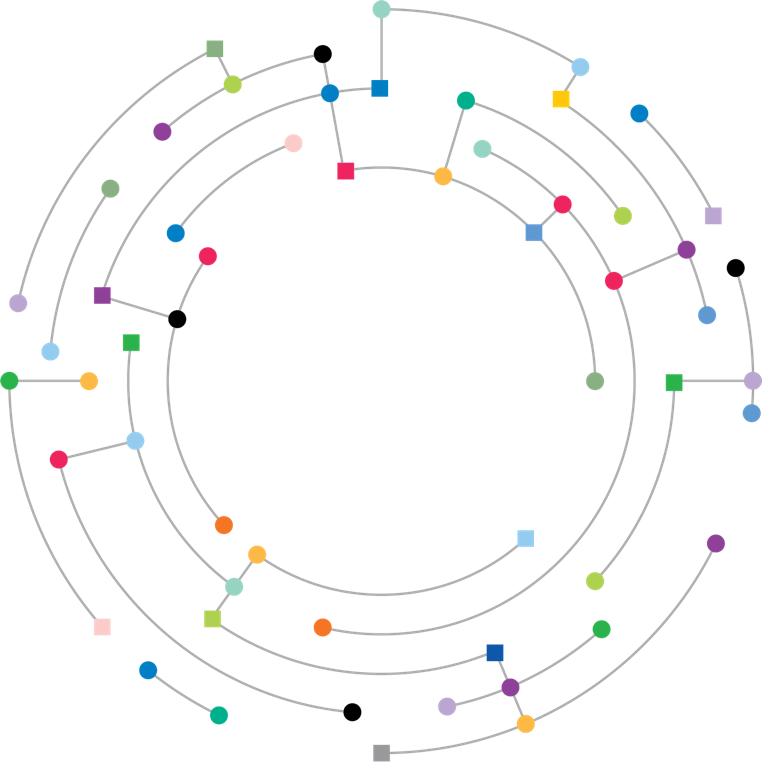

EvaluatePharma reveals 12 clinical industry assets whose mechanisms include activity at Axl, and two years ago Sumitomo Dainippon Pharma bought Tolero, whose pipeline included the Axl inhibitor TP-0903. Bergenbio also has an anti-Axl MAb that should enter the clinic in fibrotic diseases this year, while ADC Therapeutics has picked up rights to an Axl-targeting antibody-drug conjugate.

Such moves underscore the importance of biologicals but, as World Lung heard, small-molecule kinase inhibitors are set to remain highly relevant for some time yet.

Article via evaluate.com